How do you create a fair and attractive equity program that entices key people to invest their skills and knowledge for the right period to build a successful business?

One of the interesting things about being an executive compensation lawyer is seeing the range of ways in which that question is answered. Companies at different growth stages and industry sectors tackle that question differently (which, of course, has changed over time and can also differ to some extent by region).

For U.S. high-growth startups, the answer is often to distribute equity stakes broadly (e.g., restricted stock and stock options initially, sometimes followed by restricted stock units at a later point), keep the award terms simple, and (hopefully) allow holders to ride the upside, often long after they have left the company. A common model looks like this:

In private equity-backed companies, equity stakes are often more concentrated, with a premium put on increasing equity value during what is typically a 3-7 year investment lifecycle and aligning the employee’s share of that value with the employee’s period of service. Among U.S. public companies, equity is typically awarded every year, generally through a mix of different vehicles, distributed more widely and, at least among C-suite executives, controls on liquidity (such as through ownership guidelines and clawbacks) are common. Life sciences, financial sector, and real estate companies (and many others) all have some of their own styles and approaches.

Of course, though, circumstances change. Startups become emerging growth companies. Emerging growth companies go public. Public companies get taken private. And customary approaches can be unduly constraining (and often have limitations that can severely undermine the purpose of the incentive equity scheme – see poor Randall’s plight, for instance). We find it is useful to look ahead and look around to drive the best results.

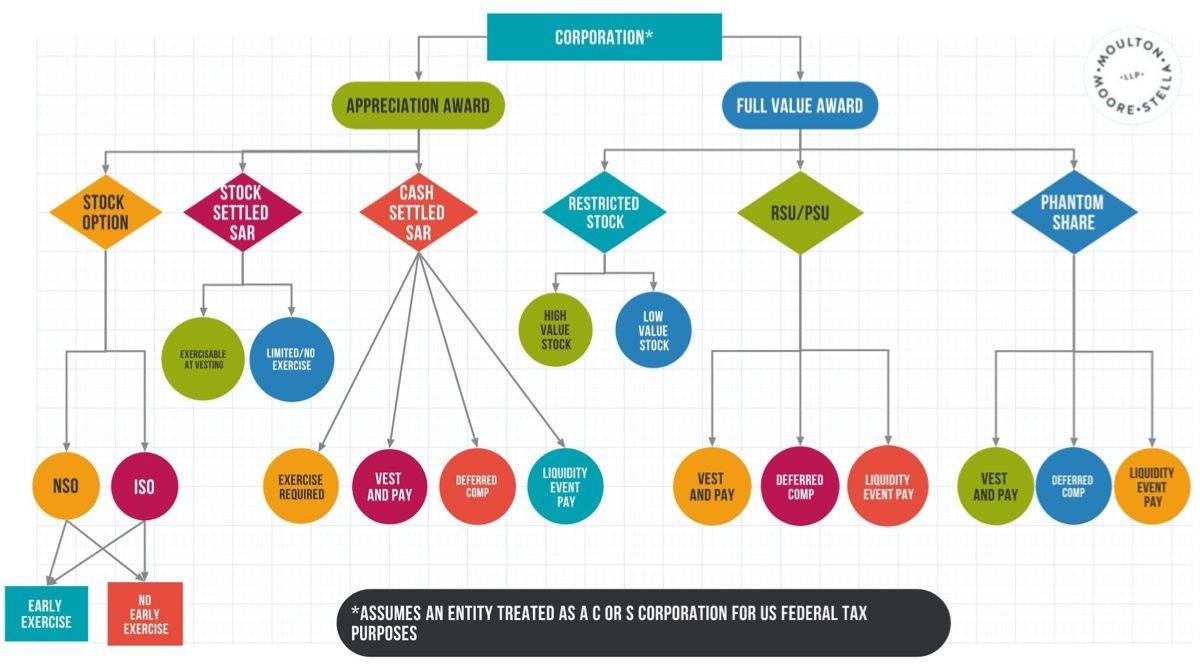

With that in mind, we offer the following high-level map of different fundamental structures of corporate equity awards (that is, awards of entities structured as C or S corporations for U.S. tax purposes). One can quibble with the terminology (which is not uniform in the world) and the extent to which some awards merge into each other at the margins (e.g., certain phantom share awards are structured as cash-settled stock appreciation rights, or “SARs”), but we think it generally covers the field.

In future posts, we will give a similar overview of fundamental structures for companies organized as partnerships for U.S. federal tax purposes, and take deeper dives into some of the design, tax and other issues that influence award design.

For more information on our equity incentives practice, please email us at hello@moultonmoore.com.