One of the enduring mysteries to come out of the late 2017 legislative whirlwind known as the Tax Cuts and Jobs Act[1] is how Congress came to pass a special incentive equity tax regime for unicorn (and other larger private) companies that almost immediately became a dead letter.[2] (For those steeped in these matters: we are talking about Section 83(i) of the Internal Revenue Code.) In this post, we try to explain why it failed. We will defer to folks on Capitol Hill and K Street to explain how it came to be in the first place.

The “Problem”

By the mid-2010s, technology companies were staying private longer than in the past. This situation created tax headaches for “mature” private companies stemming from mismatches between when employees (and other service providers) must pay taxes and when cash is available to pay those taxes. Generally, this is less of an issue for startups and early stage companies because they can more readily use low-value restricted stock and incentive stock options to minimize the need for significant tax payments by holders prior to liquidity events. At the other end of the spectrum, public companies rarely are pinched by this issue because employees can usually sell shares into the public market for cash. When they cannot (e.g., due to blackout windows or short-swing profit rules), because they tend to be relatively cash-rich (though not without exception), public companies often “net withhold” shares from awards (i.e., hold back shares with sufficient value to cover withholding taxes) and merely substitute cash from the corporate coffers for employee cash.

The “Solution” that Wasn’t

Section 83(i) was supposed to be a part of the solution to that problem. It was going to allow employees to acquire shares under options or RSUs while deferring taxes for up to five years, until more cash was available to pay them. As an added bonus, the acquisition of shares under those options or RSUs would start the holding period for long-term capital gains (and, in some cases, qualified small business stock) purposes, making reduced (or non-existent) tax rates on the subsequent sale of the shares possible.

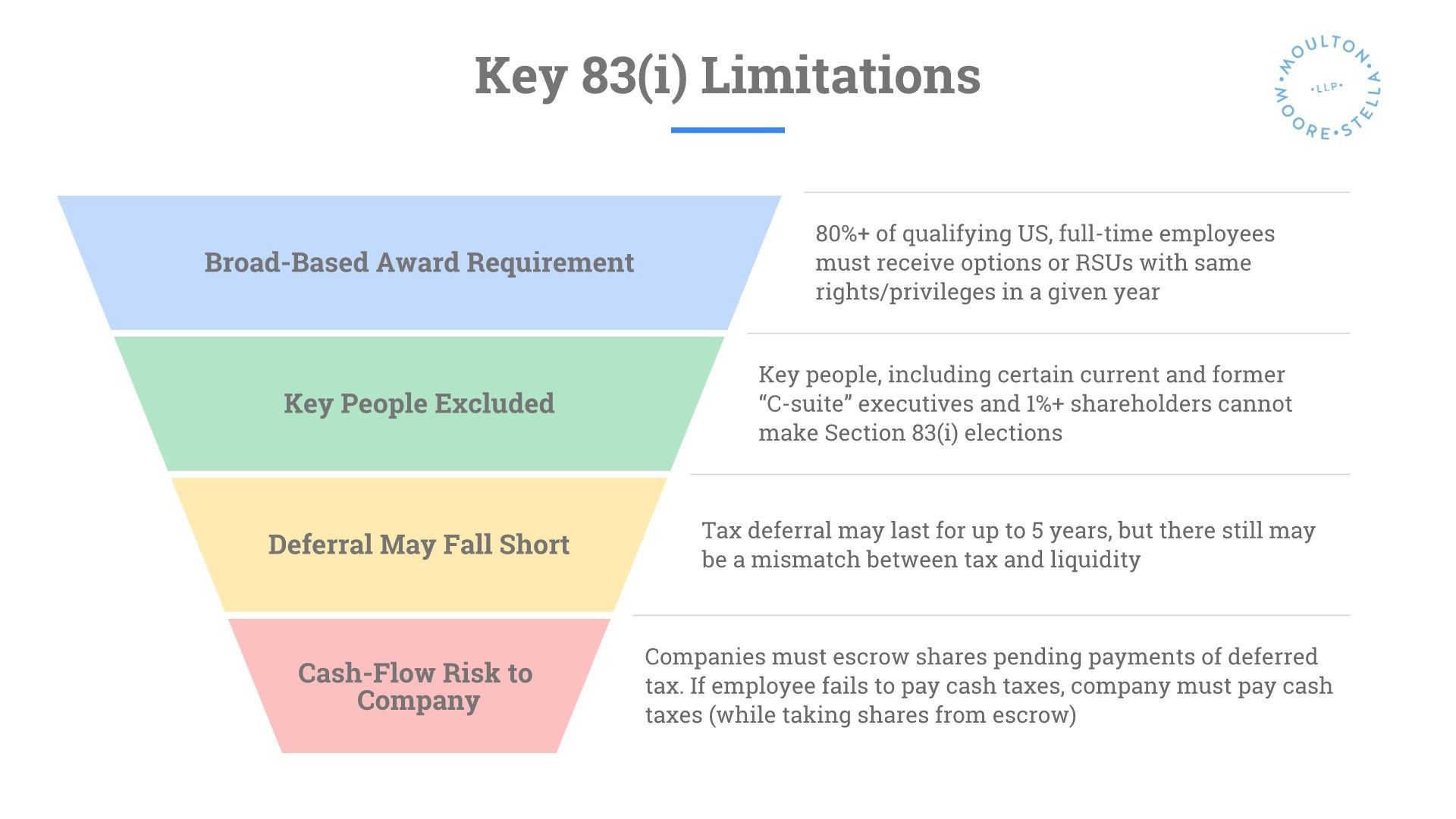

So why is no one using Section 83(i)? In short, Section 83(i) attaches too many strings to the “solution” to the problem it is trying to solve to make it viable. Some of the key limitations imposed under Section 83(i) are noted below.

Broad-Based Award Requirement

We expect that many private companies that have considered Section 83(i) have concluded it is economically and logistically impractical to provide qualified Section 83(i) stock option or RSU grants (with no mixing and matching) to at least 80% of their U.S. full-time employees for any given calendar year. While equity grants are often widely dispersed in high-growth startups and emerging companies, they are not typically granted on an annual basis (as is more typical in public companies). Transitioning to this type of program would require substantial changes to market realities and historic practices.

Key People Excluded

Many service providers, including all contractors, CEOs, CFOs, certain other highly compensated executives, and people who previously occupied those roles, as well as 1%-or-greater stockholders, are not even eligible to make Section 83(i) elections. For highly compensated executives, phantom income tax issues are often exacerbated, given the relative size of their stock option and RSU awards as compared to other holders (though they also receive more cash compensation). Private companies are less likely to invest in legal and other service costs to implement a Section 83(i) tax-deferral arrangement when senior management cannot participate.

Deferral May Fall Short

Up to five years of deferral is nice, but what if it isn’t enough? There is no guarantee that a liquidity event would happen within that timeframe. While five years of deferral buys time to find cash from other sources, it creates an uncertainty that may dissuade many companies from going down this path. In addition, taxes would be accelerated to the time a company’s stock becomes publicly-traded, even if an employee were subject to a “lock-up” provision that might limit his or her sale of shares during the first six months or so following the IPO.

Cash-Flow Problems

A holder of a stock option or RSU can only make a Section 83(i) election if the private company enables it. Under Notice 2018-97, a private company can preclude its employees from making Section 83(i) elections by declining to establish a share escrow arrangement to fund withholding tax obligations triggered at the end of the applicable tax deferral period. When withholding taxes are due in connection with the exercise of a non-qualified stock option or the settlement of an RSU, the delivery of shares can generally be conditioned on delivery of sufficient cash to pay withholding taxes. The Section 83(i) share withholding regime requires companies to rely on the employee to produce cash for taxes years later (in many cases, long after the employee has left the company). In many cases, this would give the employee the option of shifting the cash-flow burden onto the employer. This result is far from ideal and does not provide a solution to the underlying problem – that neither the award holder nor the company may have cash to pay the applicable tax withholding bill if equity values have skyrocketed by the time of the election (which is almost always the goal and a phenomenon that has generated considerable private wealth across the globe).

AMT Changes

On top of all that, at the same time that Section 83(i) was added to the Code, the alternative minimum tax (“AMT”) exemption amount was increased, thereby reducing the AMT bite that certain employees would see from incentive stock options. This made them even more attractive as an alternative to Section 83(i).

In its present form, we do not think Section 83(i) is likely to increase much in popularity unless the law is changed. For now, there are alternatives that, while imperfect, more readily address the problem identified above with fewer restrictions. But sometimes the law evolves and parts that were once dusty outposts in the Code can grow in importance, so we are staying tuned.

For more information on our executive compensation practice, please email us at hello@moultonmoore.com.

[1] Because of arcane Senate rules and the legislative process by which the law was passed, the law’s name was stripped out at the 11th hour so the law is officially called only “Public Law No. 115-97.”

[2] To be fair, the Joint Committee on Taxation estimated that the total “cost” over 10 years associated with Section 83(i) would be “only” $1.2 billion – a drop in the bucket in the context of the federal budget or the cost of the changes in law. It may be more accurate to say that the JCT correctly predicted that there would be very limited use of the new provision but in our experience the uptake level has been below even those modest expectations.